Who are you without your credentials? In the quest to fit in, I forgot to be myself.

Don’t make the same mistake that I did. Fitting in is overrated. You should never feel pressure to make yourself look like who (you think) others want you to be. We are all better off showing up as we are and attracting whatever it is that truly is ours. At the end of the day, to attract a life that fits you well, you need to show up as you.

“My medicine has always been a dose of madness.

A dose of madness, do you want to try it?

Prove what and for whom?

And if the cure is just

Not needing to prove anything to anyone?”

I took a breath and looked around the room. Dozens of writers were typing away confidently, but all I could think of was the blank page in front of me — no words would come out. I was in a creative writing retreat, and on that morning we were asked to write a bio of ourselves. But there was a twist: we could not mention our careers, any institutions, or credentials. I racked my brain for minutes and scanned through every memory to try to find a story — my story. Suddenly, the simple act of introducing myself paralyzed me. How could I capture who I am without these things? I didn’t know where to start.

As others shared their bios, I understood the assignment. Their life experiences, interests, dreams, and memories were more interesting than any degree. We all have complex stories, and when you remove our credentials —especially in this digital age where social media is making us used to highly curated representations of ourselves — the complexity shines through. I highly recommend this exercise.

For example, in a regular bio, I would have written something like “I recently graduated with a master's degree in journalism with a focus on long-form storytelling.” But on that morning, I wrote that when I was 16 years old, my hometown — São Paulo — was taken over by violent clashes between the police and the prison gang PCC. As I passed the carcass of a bus that had been consumed by flames, I found myself overwhelmed by questions and a deep desire to understand the world around me — all of which ignited a passion to tell stories. I don’t know about you, but I think the second bio is more interesting.

The writing retreat was my graduation gift. I wanted to get my creative juices flowing before starting the next step in my journalism career. But the thing is, when I went home, I forgot about that lesson.

But before I tell you about what happened, you need to know a bit more about me. I moved to the U.S. 12 years ago, and have been working as a fashion model since then. When I enrolled in my master's program, I started to realize how different my story was from everyone else’s, and how my professional background was pretty obscure in the eyes of most people in school. Besides, there were few international students living permanently in the US. As a woman, an immigrant, and a fashion model, I knew some people just wouldn’t take me seriously.

So, when I graduated — and started to look for journalism jobs — I knew I had extra challenges. And to try to convince employers that I’m qualified, I decided to hide my story. In an attempt to be perceived as “normal,” I sent out generic applications, and only mentioned my credentials and skills. Ironically, I did the opposite of what that writing workshop taught me.

Well, no surprise that didn’t land well…

When one of my career mentors saw my cover letter, she looked at me like she was about to yawn:

“This sounds boring. What about your story? There is no sense of who you are and why you want to be a journalist.”

Hiding my story meant hiding myself, and well, also my potential as a journalist. If people can’t see us, of course, they would not find us interesting. There was no sense of passion in those letters.

“You sound like just anyone who gets into journalism for no good reason rather than making some money and getting a job,” my mentor said.

I was telling my story the way I thought it should be told, instead of the way it is. In the process, I left out everything that’s interesting. And the truth is, everyone has a different story, and that’s what makes us unique. Expecting to fit in by pretending to be someone else (or by hiding part of your journey, in my case) is disrespectful to yourself. I realized that I was insulting my beautiful, messy being, by assuming I needed to hide for acceptance.

Don’t make the same mistake that I did. Fitting in is overrated. You should never feel pressure to make yourself look like who (you think) others want you to be. We are all better off showing up as we are, and attracting whatever it is that truly is ours. At the end of the day, to attract a life that fits you well, you need to show up as you. Remember, we all have a different and interesting story, and it’s your job to find the courage to tell it.

I hope you fully embrace yourself, your background, your journey, and everything that makes you unique. Share it proudly everywhere you go!

How to deal with spending problems

Spending problems are real, and it is common to find people living with it without ever realizing how it impacts their finances, personal dreams, and future. Usually, compulsive shopping leads to reckless spending, which can lead to debt and low credit scores.

Spending problems are real, and it is common to find people living with it without ever realizing how it impacts their finances, personal dreams, and future. Usually, compulsive shopping leads to reckless spending, which can lead to debt and low credit scores.

But shopping can also make you feel better, and sometimes it comes with a guilt-ridden feeling when you receive your credit card statement. Does it sound like you?

You're not alone. Up to 16% of the American adult population is affected by compulsive overspending. And personal finances are heavily influenced by your spending habits.

When you combine what feels good, along with the convenience of shopping whenever you want, it's easy to get carried away. There may be a few of these situations that apply to you if you are prone to reckless spending:

Shopping makes you feel better – and guilty, sometimes

Shopping without a purpose

Undisclosed spending

Growing debt

If these problems are common to you, you have to be aware that money plays a key role in achieving your life goals.

Getting your spending under control starts with setting goals. You can have financial goals of any length, from breaking the paycheck-to-paycheck cycle to traveling around the world.

With a clear idea of your goals, consider how much it will take to accomplish them. Save and invest every month, even if it's less than you need to accomplish your goals, focus on creating a habit in the first place. Even small changes over time can lead to big results when it comes to curbing habits.

Easy steps to wise spending:

Shop for groceries with intention: you know what you need because you have a list, even for junk food.

Shop online with purpose: be aware of small online expenses and don't buy things you don't need right now. Do not buy something today if you can get it tomorrow.

Stop solving problems with new products: if you can fix something, you can save money.

Social media detox: unfollow and mute pages that make you consume more. Keep an eye on your consumer triggers.

Make a budget: you can set aside money for pampering yourself. No need to be greedy, but you should know how much you can spend per month to reach your financial goals.

Also, remember that reckless spending can be a sign of anxiety and other mental challenges, to which we are all exposed. So, remember not to compare yourself with anybody and exercise every day, even if just for 20 minutes. It helps to fight anxiety and depression by balancing the hormones in your brain.

Finally, if you've just discovered you might have spending problems, don't worry and be kind to yourself. Making one habit change at a time is more powerful than you can ever imagine. You just need to move forward.

How caring for a loved one made me more caring (and jaded)

A few months ago, I wrote "Heart Split into Two Homes," a piece in which I shared my experience being a Brazilian immigrant with her heart split into two homes. My "heart" in this context was my grandma. I started the essay with something she told me before I got on the plane: "I see you everywhere. I miss you so much already, but I know you're happy and well, and I wish you all the best. You deserve it. That's what keeps me going. I love you so much." In case you missed it, she is the one who raised me when my mom moved from Brazil to NYC. She’s also the person in my life to whom I’m the most attached.

I didn't think I'd be visiting her anytime soon. With a year filled with events and my wedding coming up, I thought that maybe I wouldn’t be able to return to Brazil until 2024. Tickets are usually expensive, and I wanted to enjoy summer in NYC. But here I am, writing this blog post as she's next to me, taking a quick nap on her comfy chair in my hometown.

She cared for me the last time I was here in April. She made her delicious meals (her love language), asked me to be careful every time I left the house, and we took our daily naps on the couch. But her health has been concerning us. She just turned 86 in May, and most people didn't even believe she was that old. She's always been a very strong, independent, sweet lady. However, over the past year, we've noticed changes in her voice. It was getting harder to comprehend her. Her legs were also not the strongest—she couldn't walk without leaning and guiding herself with walls. She was also diagnosed with depression, which we believe worsened due to the COVID-19 pandemic and isolation months.

Then, at the beginning of June, she fell in the bathroom. She broke her arm in four parts and her collarbone. After that, things regressed: her speech became even harder to comprehend, her legs just gave up, and the woman known to care for so many of us is now the one who needs care.

After a few misdiagnoses, we finally got our answer: Amyotrophic lateral sclerosis (ALS), also known as motor neuron disease (MND) or Lou Gehrig's disease. According to Wikipedia, this is a neurodegenerative disease that results in the progressive loss of motor neurons that control voluntary muscles.

I decided to come back and work from here while I help out. I remember when my grandparents (mom's mother and father) passed away a few years ago. That feeling of not being able to say goodbye or spend more time with them before they "left" broke my mom's heart. So, thanks to my ability to work remotely, I came. Selflessly and selfishly at the same time.

Many people tell me: that's so sweet of you to help take care of your grandma. That's so special, that's so...[insert sweet comment here.].

But in reality, I think she's the one who's still taking care of me, even if I'm assisting her. It's something I've never dealt with before. I'm not a mom, and the only other beings I've truly "cared" for were my cat, my plants, and sometimes my fiancé when he's sore or being a baby. So, being a "caretaker," to the woman who dedicated a good chunk of her life to me, has been an incredible growing experience. (Also, shoutout to all caretakers, hospital workers, nurses, etc. You're the real MVP.)

This situation reminded me of those clichés in life we take for granted at times. It made me appreciate those around me more and not be scared of saying I love you more often. This also made me want to take better care of myself and lowered my tolerance toward complaints from myself and others. Don't get me wrong: sometimes we need to get it out of our system, and we all need a complaining session with our friends and therapists from time to time. But I've become jaded towards people constantly complaining about superficial things—the things we can control.

Everyone talks about the concept of "life is short," but only a few of us truly live up to it. And perhaps living up to it is not necessarily taking trips, quitting your job, or whatever things we watch in movies: maybe it's just being thankful for the small wins and taking care of ourselves. Whatever that may be.

Why do central banks raise interest rates?

Why do the Fed and other central banks raise interest rates? How does that affect the economy? Find out today.

Central banks are raising interest rates around the world due to escalating inflation. In the US, the Federal Reserve has jumped interest rates from 0% - 0.25% in 2020 to 1.50 - 1.75%, and monetary authorities indicate there will still be more this year.

But why do the Fed and other central banks raise interest rates? How does that affect the economy?

Each country's central bank, which generally works independently, is responsible for maintaining price stability in the economy, and in the U.S. this responsibility falls on the Federal Reserve.

The effects of the Covid-19 pandemic and then the war in Ukraine drove inflation higher. It happens because when the economy booms, distortions such as inflation can occur, threatening the economy's stability.

By raising the federal funds target rate, the Fed aims to increase the cost of credit across the economy, thereby cooling down the economy. In practice, higher interest means that credit is more expensive, as money costs are rising.

Businesses and consumers both end up paying more on interest when thoseinterest rates increase. As a result, high-interest rates discourage consumer spending, especially on financed goods such as cars and real estate. Households will reduce their spending as they save more, resulting in a drop in inflation.

In times of high-interest rates, what should you do?

Interest rates affect borrowing costs, mortgages, pensions, and savings. The Federal Reserve's interest rate increase has a ripple effect throughout the economy, which means other rates will rise as well.

In these moments, it's important to avoid loans and mortgages unless you cannot postpone them for a long time. If you need financing in the coming months, specialists recommend locking in the interest rate before it goes up, and make sure you pay off your credit cards on time as well.

In response to the Fed's rate increase, Adjustable-Rate Mortgages (ARMs) are expected to raise their interest rates, but fixed-rate mortgages will not be affected by it.

In contrast, CDs and savings accounts are paying more for your money, with some savings accounts offering rates of 1.5%, up from 0.20 percent last year.

There are no positives in long-term high inflation, and the rise of interest rates also means slower economic growth, but it's a necessary measure to control inflation and maintain a healthy economy.

Here's why we need to talk about our uteruses more

The past few weeks have been horrifying for women and assigned female at birth (AFAB*) bodies.

Not only do we, as a society, have to deal with the terrifying news of mass shootings and increased gun violence in this country, those born with uteruses also have to face our freedom and access to reproductive rights in jeopardy because of overly conservative and overly ignorant people in power.

While there's a lot to unpack on the subject, I wanted to debate the importance of discussing our uteruses, especially in times like this.

The uterus and its nuances

Brazilian artist Anitta shared on Twitter her struggles with cystitis and how it took her years of suffering to finally figure out that she had endometriosis. According to Mayo Clinic, "endometriosis (en-doe-me-tree-O-sis) is an often painful disorder in which tissue similar to the tissue that normally lines the inside of your uterus — the endometrium — grows outside your uterus. Endometriosis most commonly involves your ovaries, fallopian tubes, and the pelvis' tissue lining."

She was opening up about her journey and how much pain she was in during one of her most recent concerts in Europe. I felt seen, and so did many other women who replied to her tweets. Amongst the sea of empathy and helpful tips, you still saw misinformation and judgment (!!!) from ignorant people.

Why do we feel judged for something we literally can't control?

It's still weird for many menstruators to discuss any issues related to their reproductive health. Speaking for myself, I felt strange saying "period" or "menstruation" for many years.

I got my first period at only ten years old and felt ashamed. I couldn't go to the pool with my friends, had to skip dance and sports classes, and always had a problem with heavy periods and hormonal imbalance. I'm 5'7 today and wasn't much shorter than that when I was 10. People would look at me like I was different and made me feel that way. I also developed a curvy body with larger breasts earlier in my life, which was highly problematic growing up. The attention I got was not one that a girl my age—or any age—should've had (but that's a whole other topic we can dive into another time).

Back to my uterus: I had trouble understanding what was happening without the internet as we know it today and other young menstruators going through the same issues and talking about it.

My first time going to a gynecologist was around 18. I'm not sure why it took me this long, but I blame the stigma around it and the lack of conversations about the topic. I didn't know not every menstruator had week-long, heavy periods. I didn't realize it wasn't common around my girlfriends to have that much pain during "that time of the month."

After a few years of going to the doctor, my periods worsened. I then discovered I had fibroids when I was around 24. Healthline.com describes it as "abnormal growths that develop in or on a woman's uterus. Sometimes these tumors become quite large and cause severe abdominal pain and heavy periods. In other cases, they cause no signs or symptoms at all. The growths are typically benign or noncancerous."

Finally, an explanation as to why something so natural felt so awful.

I started being honest with people when they asked me how I was feeling during my period. I would be brutally honest and noticed that some people would feel uncomfortable hearing about mine. Other menstruators felt empathy and were open to discussing their problems with their uteruses. Luckily, now I can work from home if I feel pain, but I've had to call out of work before or go in feeling the absolute worse and looking like I didn't want to be there (and I definitely didn't...)

I've also struggled with cysts and suffered awful side effects from birth control pills. And many people didn't understand that I wasn't taking it to "avoid pregnancy," but I was looking for ways to have a better quality of life. And I'm still on that journey. Discussing these helped me understand what other people are doing when in similar situations.

The latest news from the Supreme Court's decision on Roe v. Wade reminded me that many people, even menstruators, do not understand the bodies with uteruses. They do not understand the issues they can have, what problems they can go through and the risks many women and AFABs face during pregnancy. This list goes on and on.

On uteruses and religion

Separation of Church and State should be the norm, but it feels like a dream lately. When I discuss the latest news with friends and family members that consider themselves very religious, they see me as someone who no longer believes in God.

I have no shame in saying that I, Livia, would probably not have an abortion if I got pregnant today. Today. With my partner, with the jobs we have, and the support system I got. But if I was in a situation in which my life was literally at risk, I can't say the same. So, we never know until we need to face it.

But, regardless of what I would do in my own life, I have no right to judge others with different beliefs, let alone support laws and systems that aim to govern based on Christian beliefs.

The U.S. is home to people from all backgrounds, immigrants from all over the world, and so many religions. To be a true American is to respect that. And the Supreme Court and conservatives are definitely not living by that rule.

More talk about uteruses. Less talk about your own religious beliefs.

*Assigned female at birth (AFAB) - a person of any age and irrespective of current gender whose sex assignment at birth resulted in a declaration of "female". Synonyms: female assigned at birth (FAAB) and designated female at birth (DFAB).

Imposter Syndrome: how to recognize it

Are you aware of anyone who does not believe they can complete a task? Do you feel that you are not good enough for a promotion at work, even when everyone tells you otherwise? You may be experiencing imposter syndrome.

According to experts, this is not considered a disease, but rather a disorder of self-perception, like looking in the mirror and not being able to see the real you.

Imposters are prone to self-sabotage, having a perception of incompetence or inadequacy. There are a variety of negative feelings that are related to this syndrome, such as low self-esteem and insecurity.

The person achieves several positive results, but cannot imagine themselves as part of that. They believe that their achievements are the result of some other factor. According to experts, it is a syndrome related to abilities, skills, and undeserving. Among the main causes of this feeling is a high level of demand in childhood, but it also results from social life, particularly among shy people.

Do not panic if you identify with these characteristics. At some point, we have all struggled with imposter syndrome, but we can outgrow it by understanding our problems and difficulties.

Symptoms of imposter syndrome

Procrastination. A common symptom of imposter syndrome is procrastination. As in this case, insecurity arises from uncertainty about the tasks to be performed. It is important to know where procrastination comes from before you can determine if it is truly related to imposter syndrome.

Self-sabotage. A person who has this syndrome can also run away from certain experiences in which they don't feel safe to play a significant role. As a result, they miss out on many good opportunities.

Self-depreciation. Be aware if you talk negatively about yourself very often: this is also an important red flag.

Excessive self-criticism. While it is important to evaluate our actions, for those who suffer from imposter syndrome, this becomes completely excessive. Those people seem to lose the ability to learn from mistakes and punish themselves constantly.

Comparison. Last, but not least, comparison is the main sign of imposter syndrome. In general, it seems like people can only find good qualities in others, not in themselves. As a result, we live in an endless race towards an ideal of perfection that doesn't match anyone's reality.

How to deal with imposter syndrome?

Many symptoms and signs of imposter syndrome get worse if cultivated, and it can be very difficult to recognize that we have it. Self-knowledge and making a positive assessment of situations in your life can be the first step, but the ideal thing is to reach out to a therapist to diagnose the exact cause of the syndrome.

The wait for the "bikini body" shouldn't be endless

Rummaging through drawers, my best friend found some old photos of us from the late 90s. She immediately sent it to me. How fun it is to have the opportunity to travel in time through these pictures!

The first thing that struck me — aside from the inexplicable tribal henna tattoo I wore on my belly that summer — was how skinny I was. Curiously, as far as I remember, I didn't feel skinny back then. The so-called bikini body has always seemed to me like a distant dream. I was always terrified of gaining weight, and I had never felt my stomach was flat enough.

Wondering how I could feel inadequate in that shape, I shared that story with a few friends and, after a while, on my Instagram account. Almost instantly, I got lots of similar stories.

Unfortunately, many of us learn about body dissatisfaction at very early ages. And once we believe that we have a list of physical flaws to improve, a new chapter starts - the endless pursuit of the bikini body.

Wanting to improve, in general, is something good. The problem is waiting to have a specific type of body to feel confident enough and do whatever we want. To go to the gym using a crop top; to have sex with the lights on; to start a new sport; to ask for a raise; to get rid of a toxic relationship… to wear a bikini. You name it.

It may seem that those things are unconnected, but studies show that a poor body image can affect us psychologically, physically, and even financially. It can trigger eating disorders and a troubled relationship with food and physical activity, increasing the obesity risk and associated chronic issues.

The time, energy, and money we spend thinking about the "dream body" can disrupt our lives, and only ourselves can change that perception. As the author and activist, Virgie Tovar, wrote in her book You Have the Right to Remain Fat (2018): "I am also a 250-pound woman who chose to stop dieting because I wanted to start living my life rather than continue dreaming about it".

Can I have ice cream?

This misperception about my body started to change in my 30s when I began writing about eating behavior, beauty standards, and women's self-esteem. But it's not because I finally got "the body" I dreamed of for years. It's because I started to understand why we are so influenced by the idea that there is an ideal body type. I finally became aware of what was behind the fear of gaining weight.

And I will tell you something: there are many layers behind this fear. It would cost me another article about it, or even a book. But the important thing here is to flag when this feeling that our body is never enough imprisons us.

In 2006, Little Miss Sunshine won the spotlight and many awards telling Olive's story, a seven-year-old girl whose biggest dream was to become a beauty contest winner. I rewatched this movie recently and noticed that it remains so contemporary.

A scene, in particular, drew my attention. Olive (Abigail Breslin) is at a diner with her family. She decides to have ice cream for breakfast. Her mom consents, while her dad warns that those calories would turn into fat on her belly. According to him, that was not wise conduct for a person who wants to become a beauty queen.

After this passive-aggressive little advice, she evidently hesitates to eat the ice cream. And when she finally does, a certain amount of guilt is involved.

The ice cream is an interesting metaphor for the pressure that beauty standards put on us. It makes us put looks first, disregarding thousands of sensations that our body can offer us.

Nowadays, we talk a lot about self-acceptance. But, before reaching that, it's valid to focus on understanding the dread of gaining weight. Because even if you don't like certain parts of your body, it's essential to have respect for it. After all, how can we take care of something we don't like?

Eating well, exercising, and having a healthy relationship with your image are crucial attitudes towards mental health. We should focus our energy on what our bodies can do for us. Looks are just one part of what we represent in this world.

A body that doesn't fit the current beauty standard (unreachable for most women) still deserves to work out, love and be loved, to go to the beach, to have good quality sex, and eat ice cream. We should not allow anyone to make us believe otherwise.

Venture Capital is elite, white, and male: how that’s holding American businesses from serving vulnerable communities

When Donnel Baird read the news about the Bronx building fire on January 9—the deadliest one in New York City in three decades—his mind immediately went to his childhood. Like the 17 people who died in the tragedy, Baird once lived in a low-income building with a dangerous and inefficient heating system in New York City.

The January tragedy was tied to an electric space heater, used by a tenant because of the building’s chronic lack of heat. The news struck a chord with Baird because he had grown up using an oven to heat his apartment in Bedford–Stuyvesant, a neighborhood in Brooklyn.

Every winter night, he had to avoid going by the oven and inhaling harmful carbon monoxide and other toxins. His father, a mechanical engineer, taught six-year-old Baird how to turn on the oven and also to prop the window open with a wooden stick for the toxins to flow out. As a child, Baird urinated in a bucket during cold winter days because the oven was on the way to the bathroom – an open stove was too dangerous for a child to pass through.

Today, he is a successful entrepreneur, who raised over $100 million to fund a business that is focused on making old and dangerous city buildings—like the one where he grew up — safer. His startup, BlocPower, converts their heating and cooling systems or HVACs into sustainable electric ones that use solar power, ductless air source heat pumps and smart thermostats.

But getting the company off the ground wasn’t easy; it was hard to get investors excited. Baird found out that most people with deep pockets just couldn’t relate to his experience, the need for this business or how it would make money.

“I spoke to 200 venture capitalists, and all of them said they would not invest,” Baird said, referring to the early days of pitching his idea.

VCs are notoriously white and male – Over 80% of VCs in the US are men and 70% are white according to a 2018 analysis from Richard Kerby, a partner at Equal Ventures, a New York City seed stage venture firm. But the power gets even more concentrated when you break down these numbers by dollars: white men control an estimated 93% of the venture capital.

This gap has cost minorities, whether it’s people of color or women. Many people come up with business ideas based on the needs and opportunities that they see from their own experiences. But when the power centers that hold the purse strings have never had that experience, it’s hard

to grasp the opportunities these founders present.

Baird has a ‘screaming match’ with a VC

Baird knew from his own experience of growing up in communities that were disproportionately Black and Latin that there was a definite need for his product. But investors just couldn’t relate to his vision.

Baird says one VC even suggested he start marketing BlocPower to affluent communities and target poorer areas later down the road. The reasoning was that he could initially charge more for his product and once he had a foothold in the upper class market, he could price it down for a mass market. Baird was enraged by the idea.

“I got into a huge screaming match…We can't do that because the planet is going to burn. We only have nine or 10 years left to make massive changes in terms of climate change. We need mass market products now that are priced that way.” Baird says.

Other VCs questioned whether communities of color even wanted access to clean energy. Baird grew frustrated.

“You have a set of investors who literally can’t imagine that a woman or a person of color can come up with a good idea, much less go out and implement that idea,” the entrepreneur says.

Hyper focus on financial returns versus impact

Baird eventually found investors who were willing to bet on his idea. But these VCs were driven by a mission of social impact.

One of his first investors was Freada Klein, whose fund is the VC investment arm of Kapor Center for Social Impact. Founded in 1999, Kapor Capital is an impact investing firm that has a portfolio of more than 120 companies, and over 100 exits.

She believes that the dearth of diverse founders is not only a fairness issue, but is also a missed opportunity.

“What I think too many VCs miss is that BlocPower solution, and like many others in our portfolio, they bring money… So, it is better for everyone,” the investor says.

Kapor’s portfolio of investments is 59% female and founders of color. Klein says its mission is to fund businesses that close gaps of access or opportunity for low-income communities and communities of color. And because founders tend to search for market solutions to problems they have experienced first-hand, Kapor has a very diverse portfolio.

But funding is dismal for minorities and women overall. In the first half of 2021, Black start-up founders received 1.2% of venture capital invested in US start-ups, according to Crunchbase. Female entrepreneurs received about 2% of all venture funding, according to a report by research firm Pitch Book.

VCs’ implicit biases

Research has shown that implicit biases—when people associate stereotypes toward others unconsciously or otherwise—are pervasive in the pitching process. According to a 2017 study of Q&A interactions, VCs pose women different questions than men. While men are asked more “promotion” questions that relate to their startup’s potential for gains, women are asked more “prevention” questions about risks. The study also found that the types of questions founders are asked directly influence funding decisions.

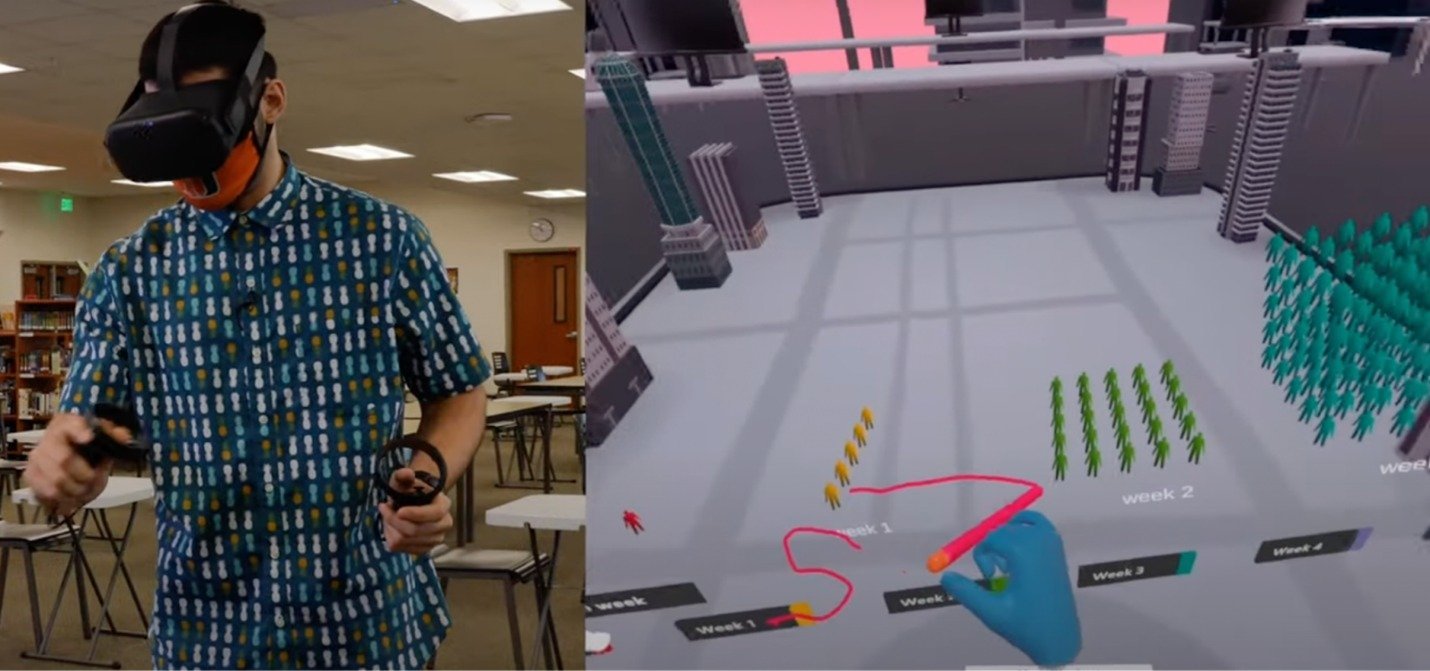

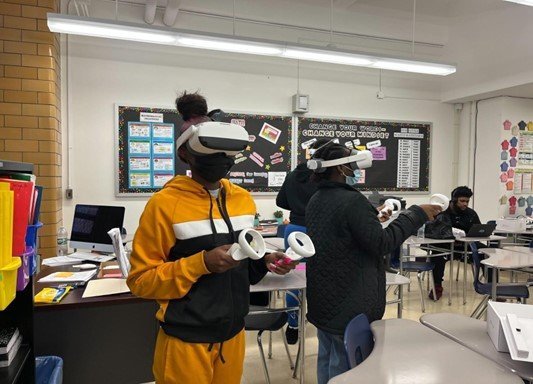

That’s what founder Anurupa Ganguly experienced when pitching her idea in the early part of 2020. She says most VCs were skeptical about her startup, Prisms of Reality, which uses VR to help underrepresented students excel in math.

Ganguly wanted to talk about her product’s potential and her ability to deeply understand the problem her business tries to solve. Instead, VCs focused their questions on the technicalities and minutiae of possible barriers to success.

She thinks VCs feared the world was not ready for her product.

“But the whole purpose of entrepreneurship is that the world doesn’t look like that yet,” Ganguly says. “And the questions that you should be asking are ‘Can you put together the team? Do you understand the market deeply enough? How are you going to grow this?”

Anurupa Ganguly. Photo: Anjelica Jardiel.

Meritocracy versus knowing the right people

Marie Deveaux is the CEO and Coach at High Tides Consulting, a Brooklyn organization that guides women and people of color in their entrepreneurial journeys. She says most of her clients find it so difficult to fund their business with VC that they end up getting their funding from another route. Most of them, she says, end up using commercial means, like going directly to a bank, looking out for loans, grants, or self funding through 401k, retirement savings, etc.

Prisms’ founder Ganguly went through a similar redirection. She grew so frustrated about her interactions with VCs, that she turned to the Small Business Innovation Research program, a federal program that supports early-stage companies in research and development. In less than a year, Ganguly built her team and refined her business model.

An educational game called ‘Pandemic’ comes into being

Ganguly slept as little as three hours a night creating her prototype. She was convinced of her idea, which was based on about a decade of first-hand experiences working in education.

After graduating from MIT with a Master’s in electrical engineering in 2009, she taught Physics and Math in Boston with Teach for America for about two years. She then became an assistant director for Boston’s public schools until 2015. Then, she moved to the NYC department of education.

In 2018, she became the director of mathematics of Success Academy Charter Schools, where she led a team to implement new approaches for teaching math. But no matter how much effort her team put into the curriculum, Ganguly still saw a substantial drop out of young women and students of color in STEM and subsequent poor career outcomes.

“I couldn’t graduate another generation of kids where I know they’re not prepared for the workforce,” Ganguly said.

She observed how young people learn experientially—through seeing, moving, and interacting with their environment.

“It’s not that the students don’t have [an] interest. There was nothing that was created for them in terms of [an] environment that allowed them to understand whether they were interested or not in math,” the entrepreneur said.

She decided to create the virtual reality learning tool to help kids work with real-life scenarios and develop mathematical models to solve them.

One of prisms’ main products is the educational game, ‘Pandemic,’ which is a simulation of the mathematics of a viral outbreak. In it, kids use VR headset equipment to see how their actions led to the spread of a virus and use arithmetic solutions to curb its spread.

“It’s not intellectual. They’re physically experiencing it,” Ganguly said.

Students try Prisms of Reality’s educational game. Photo courtesy of Anurupa Ganguly.

After completing the federally funded small business program, Ganguly decided to go back to the VC route and, this time, formally pitch.

“My credibility was questioned. Every day was demoralizing,” Ganguly said. “I saw male counterparts with way less than what I had, [and they were] able to raise money,” Ganguly said.

After some rejection, she found her first institutional investor WXR, a female-led VC fund that invests in women at the intersection of spatial computing and artificial intelligence. From there things started to pick up.

“I think had they [WXR] not taken that first bet, I would have had way more difficulty raising,” the entrepreneur said.

A self-fulfilling prophecy

At the early stages of pitching there is not much of a track record first-time founders can use to support their idea and their potential. That’s when implicit biases are most evident.

“Seed investing and pre-seed investing is and always will be a person-driven business. If it’s an idea on a napkin, you’re just betting on people,” says Andrew Chan, the associate at Builders VC.

Vinny Puji, a managing partner at Left Lane Capital, a New York-based VC firm, thinks early stage rounds reveal faulty archetypes:

“A really energetic, high-confidence, somewhat arrogant guy is probably going to be able to raise a huge amount of capital at a very high valuation, just because investors have now created a false connection in their mind [that] founders who talked like this, who looked like this, [and] who have this background are going to be successful,” he said.

American investor and former CEO of Reddit, Ellen Pao, thinks these pattern-matching strategies can become a self-fulfilling prophecy.

“They [VCs] only invest in a certain type of person. And that demographic is the one that’s successful because it’s the only thing that they invest in, and to them, that’s proof that the pattern works,” she said.

Where are all the women? One VC shares her ideas

Jenna Bryant, is a General Partner and Co-Founder at Embedded Ventures, an early-stage deep tech VC fund based in Los Angeles. Originally from Alabama, she was introduced to the VC ecosystem at 22, when she worked as a tech recruiter, helping pair early stage startups with engineers. That’s when she began to cold outreach people across the industry.

“Literally everything that I've been able to achieve throughout my decade in Tech has been through launching those connections for myself,” Bryant says.

Early in her career, she searched for other women for inspiration. “Sadly, there weren't many,” In most of the firms she worked in, she was the only woman. “Until I started my own, I was the only female,” Bryant says.

In 2018, Bryant became a partner at early-stage hard tech VC fund Riot Ventures. Two years later, she co-founded the Embedded fund, which focuses on space operations, digital engineering, and built a first-of-its-kind partnership with the United States Space Force.

Despite her success, Bryant notices that she is treated differently from her male peers, and often finds that some men don’t even take her seriously.

“I've been cat-called walking through very successful offices. I've been overlooked for board opportunities,” Bryant says.

Jenna Bryant. Photo: Bradford Rogne.

Bryant thinks the heavy lifting of expanding funds’ networks often falls on the shoulders of a few diverse team members.

“If only the diverse team members are doing that work, and there's only one diverse team member, but a team of 11, then it's not good enough,” she says.

It could be different

Donnel Baird is proud of his accomplishments, and at times he is surprised with the impact of his work.

“When you grow up poor, you aren't taught that you can change things. You're taught that you can't change things.”

But BlocPower is now creating a tide of impact. Baird has raised over $100 million– $5.5 million from Bezos’s Earth Fund. $30 million from Bill Gates’ climate Fund. His work received the attention of people like Bill Clinton and Barack Obama. The startup delivers clean energy solutions, and employs people from some of New York City’s poorest neighborhoods.

Stories like Baird’s highlight how the types of solutions in the $210 billion industry—the estimated annual US venture funding—are of interest to people across the country.

Freada Klein, the BlocPower investor from Kapor Capital, thinks the ecosystem tends to sideline her efforts as an impact investor. When asked how she responds to those who don’t take her approach seriously, Klein replied without pausing:

“Why don't we look pejoratively at Venture Capital firms that have one and only one metric? And that's financial returns. Isn't that “greed only” investing? And isn't that phenomenally limited?”

Guilt is women’s most unpleasant friend.

As I write this article, I'm about to accomplish a goal that I've dreamed of for months. When I found out that my plan was going to work, my first reaction was not to celebrate, but to cry. "Do I deserve it?" I asked myself.

Seeing me crying, my mother told me something I didn't remember. When I was a child, I won a scholarship to study in a high-ranking school. She told me that I had the same reaction at that time. Crying, I asked her: "Do I deserve it? And how about my friends?".

I'm not trying to say that I'm "the queen of empathy." In fact, most women feel guilty about something. One British survey showed that 96% of women feel ashamed at least once a day. I concluded that guilt is our most unpleasant friend.

Since childhood, we are trained to be people pleasers. In addition, we learn to assume too many roles. And it's almost impossible to succeed in each of them. Guilt is one of the consequences of this whirlwind of demands.

On the other hand, as a study suggests, men don't seem to suffer from the same ailment. A patriarchal society requires much more from women than from men. From the top of my head, I can list things that make you feel guilty daily.

Guilty because you don't feel like a good mother/wife/daughter/friend/professional. Guilty because you don't want to be a mother (or because you can't). Or because you don't eat healthily. Perhaps you pay the gym and don't go. Or maybe you are not productive 24 hours a day, and, sometimes, you want to do nothing.

Guilty for putting yourself first. Guilty because your house is messy. And because you feel beautiful (or don't feel beautiful enough). We feel guilty for being happier than the people we love, and we feel guilty even for things out of our control.

Can you add more items to this list? I bet you can.

Behind the feeling

Some specialists claim that guilt comes from the fear of making mistakes. Thus, it's more common among perfectionists and self-critical people. Another characteristic of those who feel guilty is the habit of rumination: you create scenarios about what people think about you, about what you did or said, or even about what you didn't do.

So, it's essential to know how to differentiate the guilt about actual events and that one you feel based on your thoughts (not real!). My example, some paragraphs above, is a good one: why did I feel guilty about my colleagues?

Could I pay the school for them? No. If I refused the scholarship and continued studying in the public school, would it make any difference in their lives? Also, no. Would I miss a fantastic opportunity if I had said "no"? Yes! So, the guilt is entirely useless, right? It wouldn't help me, and neither would it help my friends.

Once I read somewhere that guilt is an empty feeling. It doesn't provoke change or growth. On the contrary, it can paralyze you. It sucks your energy, taking too much space in your thoughts. It can trigger problems like insomnia, anxiety, and low self-esteem.

Getting rid of it

You may have already noticed that I'm not the best person to advise on guilt. But everything that I researched about this subject points in the same direction. You can take the blame out of your daily thoughts when you assume responsibility for your actions.

Back to the "real guilt" versus "imaginary guilt." Let's start with the real. If you know that you messed up with someone or feel that you are not doing enough in some area of your life, you can do something realistic about that. Evaluate the possibilities (maybe an apology?), change habits that bring you guilt, and pursue moves that can improve your life.

Nonetheless, pay double attention to the imaginary guilt. Maybe the feeling that keeps you awake at night is just the result of something you made up. Sometimes, we compare ourselves too much to the ideals of a "perfect mother," a "perfect professional," and a "perfect body" as we want to become the real-life Wonder Woman.

Since it's impossible to accomplish all these roles with perfection, it is beneficial for our mental health to allow ourselves to make mistakes. The guilt decreases when we create our own "quality standards." It's a cliché, but accurate: the only comparison that generates growth is the one we make with our past selves.

To conclude, it's always important to remember that our journey here, on this planet, is individual. Even the "queens of empathy" or the "Wonder Women" have to know the right time to leave the stage and let their loved ones grow by themselves.

Trust, Money, Women: what all of them have to do with crypto

Photo by Thought Catalog on Unsplash

The crypto industry is built on one fundamental principle: trust. If you want to learn the ways that all of this affects our futures, we have to discuss it. Cryptocurrencies are something all of us should keep an eye on closely as this represents a new way to trade goods and money. In other words, it's about how wealth will be created and managed in the future.

And women cannot miss this transformation if our goal is to close the financial gender gap.

Back to trust. Trust is defined by the dictionary as "firm belief in someone or something's reliability, truth, ability, or strength". Under the law, a trust is an arrangement where a person (a trustee) holds assets in trust for the benefit of another person or persons (beneficiaries). Not much new here.

Trust in our society is established by intermediaries. If you think about your bank for example, it's an intermediary that secures trust between people and companies in financial transactions (I'm not talking about a fiduciary trust, which by definition is something else entirely).

To establish trust, an intermediary must be reliable, transparent, and centralized, and here is where crypto comes in: Blockchain technology is at the foundation of crypto and trust is native to it.

In the blockchain, assets and information can be stored, moved, transmitted, exchanged, and managed without the involvement of intermediaries. It means the way our whole society is established might change, as more solutions can be designed without the need for an intermediary.

In a blockchain, trust is established by peers across a global ledger. Each peer hosts a copy of a block of data. A block is created every few minutes with all transactions from the previous minutes.

This new block of information will be linked to the previous blocks, and this is the chain: to confirm one single transaction, you must validate it in every block in the chain. This is far safer and faster than what we're used to today.

It is possible to imagine solutions without intermediaries in a wide range of industries. New fields and positions could replace many jobs, and in the coming years, we will definitely see this happening more quickly than it has in the past.

Female participation in disruptive technologies can mean social mobility, a smaller gender gap, and a future with less inequality on the one hand, but can also mean the opposite if we do not take part in it.

What I mean is that you should not just invest in crypto (although you can if you want), but you should learn about it, gain skills in technology, and realize there is no turning back to the analog world.

We must follow the money to create a society with gender equality and social justice. Men already know this pretty well, which is why 74% of crypto holders in the U.S. were male and 71% were white in 2021, according to this Gemini report.

Women are still stuck in unhappy, abusive relationships every day due to financial insecurity. We will probably see more generations still struggling with the same issues if we do not fight this right now.

Trust is power. Money is power. And power in the right hands can change the world.

How to survive inflation

Photo by engin akyurt on Unsplash

How to survive inflation

The US Consumer Price Index (CPI) recorded 8.3% annual inflation in April, down from 8.5% in March. Housing, food, airline tickets, and new vehicles made up the majority of the CPI last month, according to the Bureau of Labor Statistics.

Americans today are experiencing the highest rate of inflation in the last 40 years, which means that for the first time in their lives, they are seeing a general increase in prices in the economy.

However, the reality of neighboring countries in recent decades is somewhat different.

In the last 40 years, Latin American economies have struggled with inflation. In 1996, in Mexico, the Indice de Precios y Cotizaciones (IPC) grew by 27.70%. It was even more dramatic in Brazil, where hyperinflation led to an increase in prices of 1,792.90% in 1989.

There is much we can learn from the experiences of neighboring countries during times of uncertainty, and it is crucial to organize finances in order not to break.

Step Down

While your finances may be in order, knowing your expenses in times of inflation will allow you to plan ahead. Knowing what a priority is and cutting small, non-essential expenses are crucial.

Consider paying cash instead of credit for mandatory expenses if there is a discount. The only time financing is a good option is when there is no interest, meaning that even if you pay monthly, the full price remains the same.

Do your research to find the best prices when buying groceries, and don't be tied to brands. Give preference to wholesale purchases because the prices are generally lower.

Finally, do everything you can to pay off debt that has a variable interest rate, meaning interest rates fluctuate based on a benchmark. A benchmark can be an inflation index, or the US interest rate set by the Federal Reserve.

What comes next?

Although inflation affects daily life and the economy, it is important to remember that this sticker shock was already expected. Because of the pandemic, the government released US$ 4.6 trillion in funds to guarantee income for the unemployed and financial relief for companies, which is one of the reasons for current inflation.

There are also a number of external factors contributing to current inflation, such as the war in Ukraine, Chinese lockdowns, and disruptions in global supply chains.

Banks in the United States are already predicting an economic recession, which occurs when the economy declines for several months. During these challenging times, don't let despair overtake you, and remember that this is just a phase that will soon end.

As someone who grew up in a country experiencing decades of inflation, I know that living a step below your dreams and potential is not easy or comfortable, but it's essential, so personal finances don't become even more fragile once this economic crisis is over.

Crypto for women: Ethereum, Ether and ETH explained

Photo by Kanchanara on Unsplash

Crypto for women: Ethereum, Ether and ETH explained

Finance and women have always seemed like such dissimilar worlds, and, sometimes, they still do. In the last few years, the internet has helped close the financial gender gap, and cryptocurrencies are helping more women enter the finance field.

According to a Gemini report, women account for 26% of current crypto holders in the U.S., and they make up 53% of the "crypto curious" – people interested in getting into cryptocurrency soon.

But before investing in crypto, we first need to understand how it works. In my last article, I discussed the main characteristics of bitcoin and the blockchain technology. Now, let's look at Ethereum.

First, I'd like to explain the differences between Ethereum and Ether. Ethereum is a blockchain-based platform, or to put it in another way, it's a network. Just as the internet is a network of computers, Ethereum is also a network.

Ethereum is best known for its cryptocurrency, Ether (ETH). Ether is the native token of Ethereum's network, and it's also the second largest cryptocurrency worldwide in terms of market capitalization. With ETH, you can send payments directly to another person without the need for an intermediary.

On March 14, 2022, one ETH was worth $2,547.70.

But the Ethereum network is more than a blockchain platform. On Ethereum, software developers can build everything from decentralized lending platforms to social networks.

Decentralized System

As a decentralized system, Ethereum is not under the control of any governing authority. It is completely autonomous.

Applications that are decentralized have the potential to entirely change the way companies deal with their audiences and make money by eliminating the need for intermediaries.

As such, in the Ethereum Blockchain customers do not need an intermediary to know where their product originated, while smart contracts can ensure safe and efficient trades for both parties.

In short, Ethereum is a distributed computing platform that uses an open-source Blockchain to allow developers to build and deploy decentralized applications.

Ether and Bitcoin

As you already know, Ethereum's network uses Ether as its token (crypto), which can be used to send money to and from users without the involvement of any banks or financial institutions.

Ethereum and Bitcoin are two entirely different projects. Bitcoin is a cryptocurrency and money transfer system supported by a distributed public technology known as Blockchain.

Ethereum has taken the technology behind Bitcoin and significantly enhanced it. It has its own coding language, internet browser and payment system. It also allows developers to create decentralized applications using the Ethereum Blockchain.

Smart Contracts

On the Ethereum blockchain, applications can be created using "smart contracts". Like traditional paper contracts, smart contracts specify the terms of an agreement between the parties.

But unlike traditional contracts, smart contracts are automatically executed when terms are reached without participants needing to know who is on the other side and without requiring any kind of intermediary.

It was a computer scientist named Nick Szabo who made the first smart contract proposal in 1997, using the famous analogy to a vending machine. A vending machine has a cost for each drink, and once the coins are inserted, it will automatically run.

Like the vending machine, a smart contract can execute terms without a human intermediary.

There is so much more information I could share with you about Ethereum, such as how you can get it, the mining process, risks, Ethereum 2.0, and so on. Stay informed and up to date on crypto and investing for women in our upcoming articles.

Questions about crypto and blockchain that you were too shy to ask

Photo by Dmitry Demidko on Unsplash

I know we often postpone learning new concepts, so in this article I'd like to introduce you to an easy-to-understand way to two words you have probably heard in the past few months: blockchain and bitcoin.

We should first clarify that blockchains and crypto assets represent the convergence of technology and finance. This is not just finance, it is not just tech, it’s both worlds merged.

A blockchain operates as a public record of financial transactions, or a database that stores information in a secure and transparent way.

In addition to recording the purchase and sale of cryptocurrencies like bitcoin, the blockchain can also be used for real estate registration, among many other uses. Regarding cryptocurrencies, blockchain allows the operation of a secure and transparent financial network.

Furthermore, it is a way to circulate bitcoin in a safe and transparent manner, ensuring trust and transparency between transactions. So, that's why blockchain was introduced along with Bitcoin in mid-2008.

In a blockchain, each transaction must be validated by another computer on the network, and this is one of the functions of the technology that ensures user security.

Bitcoin is a decentralized digital currency that does not require third parties to function. It means you do not need a bank or financial institution to move your money, but perhaps bitcoin's most prominent characteristic is its independence from governments.

No government, no central bank, no country controls bitcoin trading or issuance, and that is why it is so disruptive because with bitcoin (and other crypto), we have a real alternative to geopolitical monetary control. We are witnessing something unprecedented in modern history.

Nobody knows who invented all of this. In October 2008 (at the height of the subprime crisis), a person using the pseudonym of Satoshi Nakamoto published the Bitcoin White Paper, explaining how the system would work.

There are numerous theories about who Satoshi is, including the popular theory that blockchain and bitcoin were created by a team of developers, not a single person.

When it comes to new and disruptive technologies, we are all learning, and I hope this article clarifies some concepts behind bitcoin, blockchain, and crypto in general.

The next article in this series will explore the world of cryptocurrencies and discover the most popular digital assets affecting our everyday lives, as well as how countries deal with the threat of a decentralized monetary system.

What inflation is and how to handle it

What inflation is and how to handle it

For many of us, inflation is a word that belongs in the past and was just in Economy history books. Now, it is almost everywhere, and you probably already realized prices are changing on grocery store shelves around you.

But what exactly is inflation?

Simply put, inflation is the rise in prices of goods and services. It happens when the demand for those goods and services is higher than companies can provide them. If there's a scarcity of those items, they become more valuable and prices go up.

In other words, goods and services become more expensive, and your money becomes worthless.

However, all of it was kind of predictable. To fight the pandemic, central banks across the globe boosted their economies with low-interest rates and other measures to keep things running during lockdowns. The current inflation also reflects the huge difficulties in the global supply chain - again, a pandemic effect.

In the United States, the Consumer Price Index (CPI) measures the average change in prices over time for a basket of goods and services in urban areas. As of November, the CPI had increased 6.8% from the previous year - its largest increase in almost 40 years.

How to deal with inflation?

There is no magical solution for inflation, but a few simple tips could prevent you from making mistakes that may hurt your finances. Knowing your financial priorities and goals is one of the most important resources in those moments.

In times of inflation, lifestyle and expenses should be kept simple. It's crucial to not overspend on your credit card. Due to the upward inflation, we may soon see interest rates rise, which means your credit card interest will go up, too. The other side of rising interest rates is that your savings account will earn you more interest. If you use a savings account, make sure it has a high yield.

Don't stop investing for retirement, either. Maintaining your financial goals, diversifying your investments and avoiding debt now can save you time and money down the road.

Meanwhile, you might see your Social Security or Supplemental Security Income benefits increase because consumer prices are rising. The Social Security Administration announced an increase in benefits of 5.9 percent for 2022.

Additionally, you can use apps and search to find cheaper prices and special offers. Wait until supply issues are resolved and prices are lower before making unnecessary purchases.

We do not know how long inflation will last, but we can expect some price pressure in the months ahead. Prepare your finances, so you don't have any surprises in 2022.

Why I returned my Apple Watch

Credit: Unsplash (Luke Chesser)

Last year, my husband surprised me with a gift I have been dying for: an Apple Watch. I have been eyeing one of those for quite some time, but I am too thrifty to spend $300 dollars - or more - on a watch, even if it is worth it.

Yeah… about time! Finally, I got what I wanted, but not what I really needed. So, after about 20 minutes of admiring my lovely gift, I decided to pack it up and return it. It may seem rude of me, but I told my husband I wanted to do something better with the money. Rather than an Apple Watch, I wanted Apple stock instead.

As time went by, it proved to be an excellent exchange. I got into a bull market (a slang term for when the markets are on a positive trend) and multiplied that value by 3 in a few months. Since then, I have been thinking about how that watch would look now... outdated, with a cracked screen, or making me reliant on it. Probably all of them.

I don't blame you for upgrading your devices every year. You should do whatever makes you happy, but make sure it's really what you want. I am saying this because I have recently been consuming things that I do not need or wish for... they just came up to me (such as that Apple Watch) and I have become trapped in social media's seller strategy.

According to some reports, women are responsible for about 75% of all consumption worldwide... so the majority of all publicity is also geared toward us. To make us look better, cooler, hotter, smarter, and, eventually, poorer.

As an example, if you set aside $300 a month for 35 years at a yield of 10% per year, you will get more than $1 million after that time. I know, 35 years may seem like a long time, but that money can act as a "security roof" when you retire. What will your financial situation look like in 35 years if you keep your current financial habits?

With that said, you – and me – should not wait until January to start a new way of handling money. In the holiday season (and don't forget Black Friday is just around the corner), we are more likely to fall into those traps: consuming for no reason, being broke for longer than we expected.

The holiday shopping season might be a good time to get something not only to spoil yourself today, but to treat yourself in the future as well.

I have some tips to encourage you to take care right now for the future you:

Ensure you check the prices ahead of time if you need or want to buy something, so you can avoid those kinds of "super Black Friday deals" that actually cost double what you would pay a few weeks before.

Stick to a budget when shopping for the holidays. This will help you avoid overspending on marketing tactics.

Pay in cash, avoid using credit cards. That piece of plastic is the reason many of us are in debt. Those funds are not yours, they're a loan. Place a note on your credit card labeled "loan card." This will make you more cautious about using it.

Coming back to my "consumer drama", returning that watch wasn't easy in the end, and believe me when I say that I would love to keep it. But making this decision has given me more than profits. Since then, I have more confidence to say no to things I want today and build things I need tomorrow.

Financial independence is not really about how much we make, but how much we preserve. In finance, and in life, let's keep returning the watches we don't need.

Two steps for paying off debt and building financial independence

There is never a bad time to start taking care of your finances. But making this decision seems easier than following through. And I know it!

Many women who wish to have a better relationship with money find getting started when in debt as one of their biggest obstacles.

So if you are facing debt - and obviously, paying interest rates - here are some tips I've already applied to my life when I was also in debt.

Don't worry if it seems confusing at first. There is no magic solution. This is a journey that you take step-by-step, and it is different for everybody. Let's see how I changed it and how you can too.

The highest first

First, make a list of all your debts and organize them from the highest to the lowest interest rate.

The key is to never miss a payment. If you can, prioritize paying the bill with a higher interest above the minimum.

Also, to avoid late fees, keep paying all the minimum payments. Use any extra money in your budget to pay off the first debt on your list (the one with the highest interest rate).

Keep it up month after month. Yes, it takes time, but it will be worth the effort. In my case, I spent two years paying off all my debts. As you can imagine it wasn't easy, but once it was over, it felt wonderful. I have freedom again!

Once you finish the highest debt, move on to the second one on your list. Take the total payment used to pay the first one and apply it to the second debt.

Never ever play with compound interest.

Stop spending more than you earn

As I said in my previous article, you must scrutinize how you are spending your money. Review your bank account and credit card statements over the past few months. Check how much of your spending was on needs, fun, and waste. You don't have to cut out all the fun expenses, but be sure they aren't hurting your finances.

I shouldn’t need to say, if you are spending more on fun and waste than paying off your debts, you are heading toward on the wrong pathway. Focus on eliminating your debts before anything. Again, do not play with the power of compound rates. It is the key to investing and debt as well. Make sure you can turn around and change sides as soon as possible.

After paying off my debt, I realized I didn't need to be a victim of my then-poor finance education. I realized that I could have a goal in life with money. I no longer felt embarrassed about money.

It does not matter what kind of debt you have. Make sure to pay at least the minimum every month, pay above the minimum as much as you can, and keep on track with your budget. You can do it!

Investing for women: what you need to know

The wage gap between men and women remains high. According to a report from Human Rights Watch, more women have quit the job market during this pandemic than men.

"Of the 1.1 million people who left between August and September, over 800,000 were women. Experts suggest that due to the persistent gender earnings gap across spouses and the increase in caregiving burden, women were more likely to drop out of the labor force as schools and childcare centers closed", they reported.

Those numbers are just a small fraction of the challenges women can face during their lives, which drive females to poverty as elderlies or after a divorce.

There is no manual or recipe for investing, but there are habits that, cultivated over time, will bring us closer to our financial dreams. You can invest over time for your independence without sacrificing the present.

Credit: Unsplash

Get organized and know what your goals are

If you want to start investing, organizing your financial life is the first step. If you invest while paying heavy interest on your credit card, it is equivalent to canceling your earnings. Make a list of your income (salary and other sources of income) and all your expenses (including those paid by credit card).

Take an X-ray of your finances. Analyze where the biggest expenses are, and what can be reduced or even eliminated if it's unnecessary. Make sure everything is in order.

When investing, you should also know your goals. Want to buy something, travel, reach a certain income to retire, help your family? Know the cost of your goals. This clarity of why we invest makes the practice more stimulating and helps maintain discipline.

Whatever your occupation, income, or standard of living, be clear about your goal.

What would happen if you stopped earning income today? How long can money invested in the past support your current living standards or what you want to have in the future?

I know professionals with a high living standard who invest poorly or don't invest at all. As a result, as people age, they become less willing and energetic to work at the same pace and, consequently, end up losing their living standard.

Ask yourself: What is my life goal? Will my living standard remain the same if I don't have the same health or energy to work? How do I feel about the income I have today? What can I do if not?

Credit: Unsplash

Your first investment

When investing, some mistakes must be avoided if one wants to achieve financial independence. Anyone's first investment should be in an emergency reserve fund.

You should have at least three months' worth of living expenses in your emergency fund. If possible, it must cover at least 12 months, but you should start small.

For example, a $3k monthly living cost requires at least a $9K reserve (3 months). This reserve will not be made overnight, but make sure you build it as quickly as possible.

Set aside 20% of your income every month for investments. If you cannot begin with 20%, start with 5%. Start somewhere.

Independent contractors, whose incomes can vary, should have a reserve of at least six months. Make an average of how much you've earned over the past 12 months and how much you've spent.

There are some precautions for your reserve emergency fund. Do not invest it in shares or long-term CDs (Certificates of Deposit). It should also not be in an investment with a withdrawal penalty or high tax for cashing out.

The best option for you would probably be a separate savings account or money market account, depending on the interest rate, minimum balance, etc.

Is it necessary to invest every month? When it comes to investing, there is no rule. It means that investing every month is not necessary, but you should. The sooner you stop wasting money on useless things and put it to work, the better off you will be.

To develop financial independence, beginners must maintain discipline, frequency, and set clear goals.

We are living longer, getting more opportunities, but we are still far from being financially independent. The future of women can be even more challenging than the future of men for a variety of reasons, we know that! No matter how bad your finances or your history with money may be, securing our future through action today is an act of self-love. You can do it!